Problem

If you live in the U.S., you are at least vaguely aware of the Food and Drug Administration. At a very basic level, the FDA’s job is to regulate drugs; in a similar vein, the U.S. Department of Agriculture (USDA)’s is to regulate food. In between, however, is a plethora of products that fall in between both baskets that go underregulated, unevenly regulated, or not regulated at all – and thus must operate in legal gray markets. Such Over-the-Counter product markets include health supplements, herbal remedies, nootropics, cannabis products, and (soon-to-be-deregulated) psilocybin derivatives.

When you leave the realm of FDA-regulated drugs, doubt starts flooding in. If you’ve ever tried to purchase one of these types of products, you know how difficult it is to get something that you know is good. Whether it’s health supplements on Amazon or cannabis products at a NYC smoke shop, consumers find it arduous (and not to mention time-consuming) to find products that not only fit their wants and needs, but actually contain what the brands claim. People want to have a sense of comfort about their purchases, but there is currently no mechanism in place to give them that.

However, as it turns out, brands know testing is the answer; they know that if they can get their products’ molecular breakdowns and convey it to consumers, that credibility gap between their products and FDA-regulated drugs shrinks. So why do they not currently get their products tested?

It’s simple: Product testing is a luxury that most brands don't have the financials means or time allotted to go through this process. The process is too slow to be implemented within brands’ fulfillment timelines and too expensive for anyone who isn’t mandated by law to test at an effective scale. For those who are legally required to test their products, such as cannabis cultivators and processors in New York, wait times of over 5 weeks means that products are going bad on warehouse shelves waiting for a green light, and small business owners have to face closing shop after seeing their entire profit margins eaten up by testing costs that average 8-12% of total revenues. Because the testing environment is so limited in capacity- in New York, there are currently only 15 state-approved laboratories (with over 300 approved cultivators and processors), each with relatively low throughputs- there isn’t a chance for testing to gain critical mass as a societal expectation of consumers. We believe we can change that status quo and make a real difference from day one, which is why we chose New York Cannabis Testing as our entry market.

Currently, because of this environment, everyone loses: Consumers often fall victim to snake oil sales, small brands can’t get off the ground because customers only trust big-name brands, and the lack of transparency in the space gives the entire sector a bad reputation. Thus not only is the sector’s growth stunted due to operational miscues, but social ones as well.

Thus, our grand vision is to become an alternative to the FDA, such that millions of heterogeneous Over-the-Counter products have a way to gain social viability.

When you go to a pharmacy, you go and pick up your prescription. Maybe you complain about your co-pay, but you buy the medicine, go home, and take it. You're not thinking about what's in it, you usually don't think about it working as promised, and you certainly don't think if it has any malign substances inside. Why is that? The FDA.

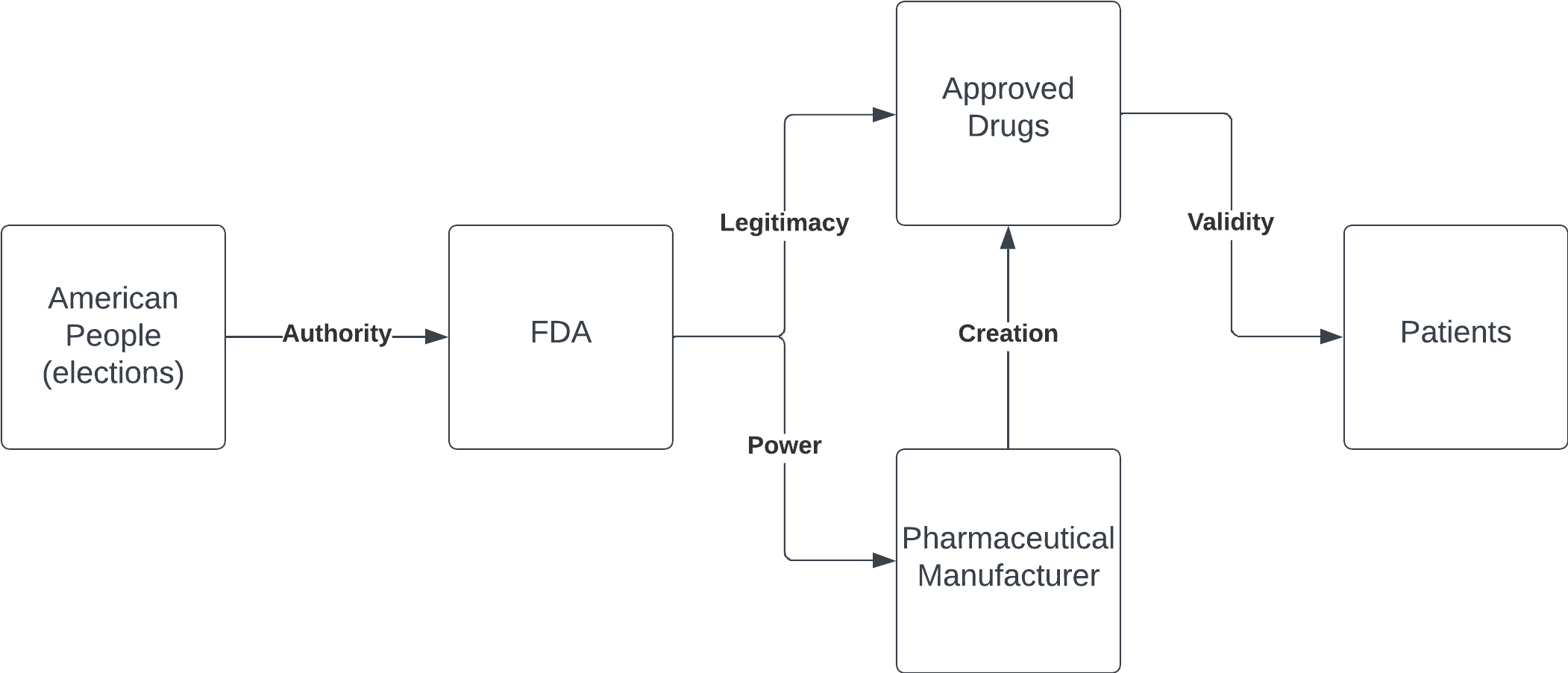

What is the FDA's job? A good first guess would be to approve and reject drugs/devices - but that would be only ~80% right. The job of the FDA is to lend legitimacy to pharmaceutical companies and by proxy, their products. Its authority comes from a few places: First (and most importantly), it is a government entity - It has a direct mandate to act from the people it affects via democratic processes. Second, it has the power not just to approve products, but also reject them. It has a defined, consistent process by which private entities (pharmaceutical manufacturers) can access its authority, but what gives those entities' products legitimacy is the fact that the FDA can pull the plug if the rules aren't followed. Using this accessed authority, pharmaceutical manufacturers can convey the legitimacy of their products subconsciously to consumers, giving them a tremendous ability to create, market, and sell their products (drugs/devices). The FDA system has done tremendous good for the world: It has enabled decades of medical innovation, resulting in billions of lives improved/saved, trillions in market growth, and millions of jobs created.

We hope to become a similar authority for products that today lie outside the purview of the FDA, and thus cannot be lent its authority. The FDA's process, while incredibly effective once products pass through, is incredibly burdensome, both in cost and in logistics/effort- and simply doesn't work for many types of products. Medicines that go through the FDA process often have one main characteristic: They are compositionally simple (and consistently so), often only containing 1-3 types of active molecules (not counting inert fillers). Most plant- and fungi-derived products contain dozens, if not hundreds, of different molecules, often in varying relative concentrations. Because of this variance, the FDA can't directly approve products that go to market (nor do most producers/cultivators/processors have the resources to go through the process anyways- the scales simply don't align). Thus, there is an enormous part of the healthcare sector that has been essentially deprived of product legitimacy simply because the products' innate characteristics simply don't align with existing methods of transferring authority. Consumers, despite wanting alternatives to the traditional Big Pharma-Driven system, struggle with taking natural products at face value because there’s no process like the FDA’s to verify their legitimacy. Until Now.

The products we work with are effective for humans because they are heterogeneous, but have to exist in the market in spite of them. We are going to flip that script.

So how do we get there, and how do the products we are building enable us to do so?

Our System

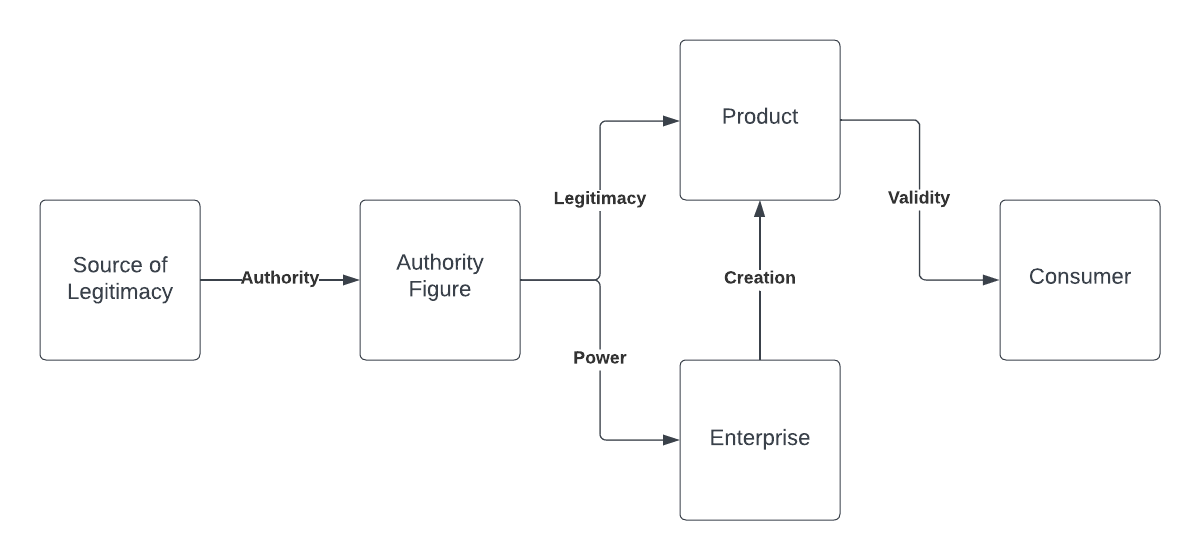

First, we help businesses by acting as a conduit for legitimacy and authority to flow. Right now, there is no mechanism to link different sources of authority to the entities that need it to sell products. Our platform is a network to establish the necessary connections for it to flow.

As this diagram illustrates, the way in which legitimacy flows from a root source to a product is through an intermediary authority figure. In the current system, the FDA fills this role:

The FDA derives its authority from the American people through democratic processes and then uses it to empower manufacturers [to create drugs] and give drugs legitimacy for patients. We aim to implement a similar system:

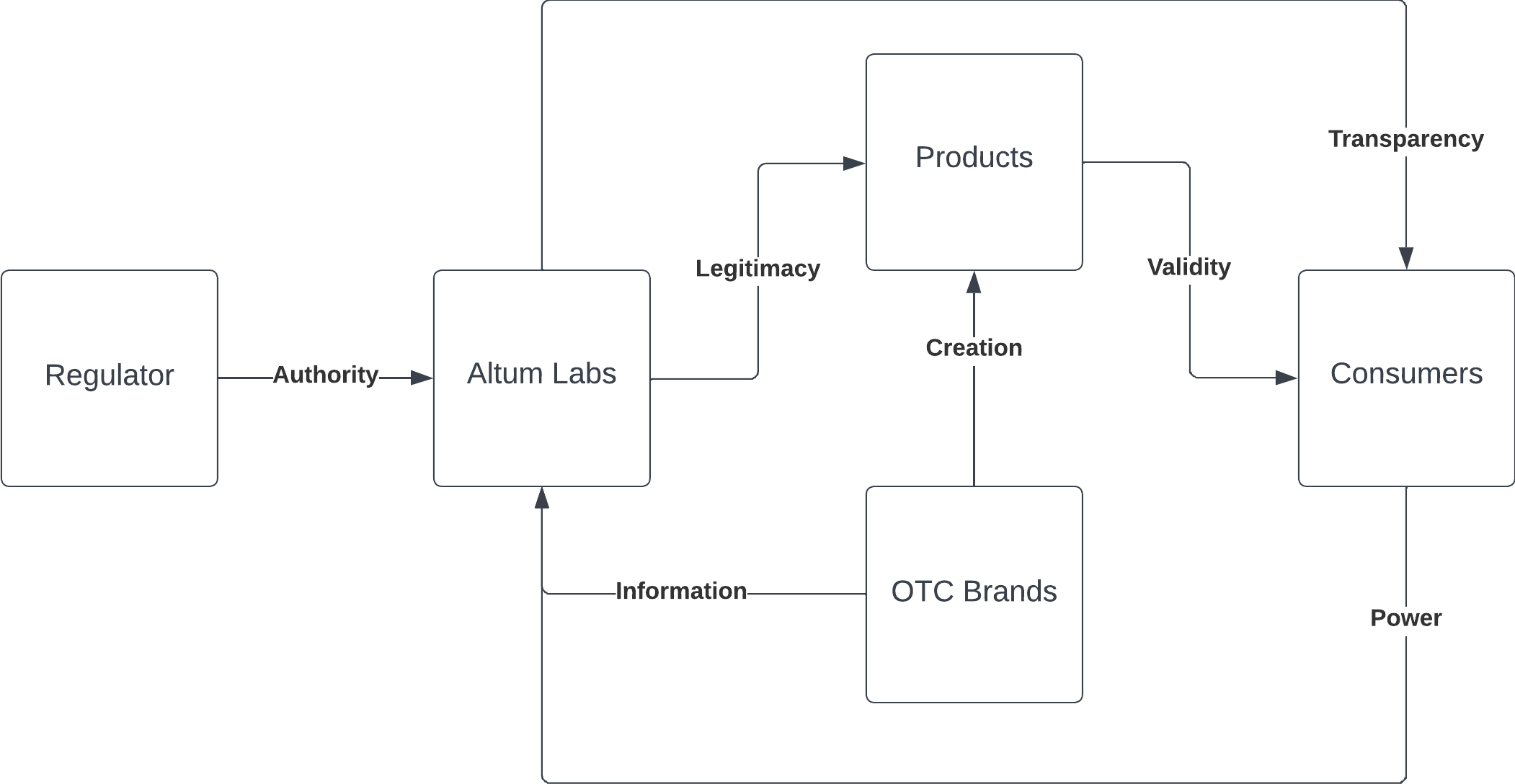

In our instance, there are a few fundamental differences that allow the system to work:

1. The authority figure (Altum) uses the authority of regulators to give legitimacy to products, but uses transparency as the means of obtaining the power to do so (from consumers themselves).

2. Brands do not need to be empowered by the authority figure to create products.

This essentially creates a new type of social verification system for products that bypasses the need for brands to be empowered in order to put legitimate products to market. Furthermore, it significantly decreases the cost and time required for each product to gain legitimacy. Legitimacy in this instance is important because it is the key factor in removing the largest barrier to purchase: Thinking. People don't want to think about products, they just want to buy them and be fixed. We enable that to happen.

The first layer of doing so is being connected to all sell-side stakeholders, which is where our web platform comes in. It allows us to be the connective tissue between brands, regulators, and labs (pre-internal lab launch), allowing them to seamlessly transfer the most important information to each's function. This benefits brands by saving time, money, and resources on compliance, labs by saving time on data analysis, and regulators by providing easy access to legally-mandated information. Being the connective tissue - a "highway" - gives Altum significant power to act similarly to the FDA by giving products a red or green light [for consumers].

Like the FDA, our "approval process" utilizes transparency to assign legitimacy to products; however, unlike pharmaceutical manufacturers, who have designated distribution points (pharmacies) that verify the product legitimacy, many of our brands are constricted, rather than enabled, by point-of-distribution legitimacy verification. In New York, for example, there are hundreds more smoke shops that distribute cannabis (illegally) than legally-authorized retailers, presenting a point-of-sale bottleneck for brands who want their products to be seen as legitimate but have to compete for space on authorized retail store shelves. Bottlenecks are an inherent trait of centralized systems; our system decentralizes legitimacy verification, eliminating the bottleneck.

This decentralized legitimacy verification system is the second layer of removing barriers to purchase; if the first layer assigned legitimacy to Altum, the second assigns it to the products that go through the Altum system. First, QR codes with our logo on each product on our platform gives a fraud-resistant way of ensuring consistency to consumers: Every time a consumer scans one, they can not only see the Altum website url used in their browser (which subconsciously transfers our authority to the site's contents) but also important information pertinent to social verification. In the FDA's system, products are verified to the public via a single public press release (which is usually accompanied by press coverage sponsored by the manufacturer), which must be searched for; in our system, that verification is accessible directly on each product via the QRs: Because regulators also have access to the system, consumers can see in real-time if that exact batch has been approved. This is crucial to the decentralized system, as it allows brands to forgo point-of-distribution legitimacy verification in lieu of making regulatory approval directly accessible to consumers.

At first, we will be utilizing external laboratories to provide the necessary molecular information for our process; however, they unnecessarily slow down the process due to inefficient procedures/operations. After we launch our web-based system, we will first focus on getting as many brands, labs, and regulators on board as possible, then will open up our own laboratory that integrates with the system not only more efficiently, but plugs gaps in upstream physical processes that can lead to downstream informational inaccuracies. Since we will have collected data from other labs and built relationships with various brands and regulators for a few months by the time our lab will be approved and operational, it will be significantly easier to onboard our own clients, establishing a natural pipeline of paying customers. Over time, as our system becomes more physically, digitally, and socially integrated, we will start rolling out revolutionary new tools for their customers (consumers) to use to improve their lives and increase the brands’ business.

How our internal lab works is simple- brands use our web platform to sign up for testing, they select a pickup time/interval, and we send a courier to them to collect samples, providing the best quality, low-hassle experience for them. We then use state of the art robotics-integrated chromatography and mass spectrometry to analyze the samples at a molecular level. Because of our data-dense, automated, scalable process (with machine learning models pre-trained on the data from other top labs), we are able to reduce systematic error by nearly 90%. From the time that the products are placed in our sampling containers to the time results are uploaded to our platform, no sample or data is touched or effected by human hands. This means our testing is faster, cheaper, more thorough, and more accurate than our competitors. In the cannabis and health supplement markets, brands expect to spend 8-12% of their total costs on testing- we aim to cut that by 3/4.

On top of providing a cheaper, faster, and more accurate testing service to our brand clients, we also are determined to provide them something other labs can’t: Consumer trust. So how do we do this? We asked some of our core consumers (n=82) about how they could trust consumer wellness products better, and the results were overwhelming. 96% (!!!) reported that simply having access to verified, accurate content information of wellness products would increase their trust in those products; a majority reported they would be more willing to purchase wellness products if they are tested by a reputable third party – and in many consumer’s minds, accessibility=reputability.

Consumer-Facing Ecosystem

Each unique QR code is then printed on the label of the product the testing sample comes from. Due to this system, whenever a customer holds up and scans the QR on a package, the website they are directed to shows the molecular information from that exact product they are holding. For most consumers, this level of transparency alone is enough to make a product more trustworthy. However, there is an additional level of insights available to those who wish to know more: At the bottom of the QR breakdown page, users can create an account on our web/mobile apps.

After opening the app and creating an account, users are prompted to once again scan a Trust QR code- doing so will automatically add the product to the user’s library. Once users have added a product to their library, they can answer questions about how that product makes them feel. There’s a variety of questions, each reverse engineered via known biochemical pathways that lead to certain neurological responses in the presence of stimuli (either sensory or chemical). Such questions range from how a user physically feels (did you get a headache after consuming this product/did this product upset your stomach?) to how their psyche is affected (rate your anxiety after consuming this product on a scale of 1-10/are you more irritable than normal?) – with the former being more common for health and herbal supplements and the latter for cannabis products and nootropics. Answers are expected to differ not only from user to user, but across product batches as well.

In an ideal world, each batch is chemically identical to the next, but we know that in reality, the relative amounts of different substances in different samples slightly differ. Because of the extremely high accuracy of the mass spectrometer/robot setup, we are able to parse out these slight differences, which normally are unclear/fall within an error range. These “deltas” can then be correlated with the differences in users’ answers; at an aggregate scale, trends start to emerge, which we then can use to continuously uptrain our ML model, of which the base set was derived from known (via literature) user responses to certain small organic molecules. Because of the sheer amount of data (millions of data points per sample, then tens of thousands of samples), the model can be trained extremely quickly. From all this data, our model is able to do something quite astounding: Predict how any substance in our data library (or combination of substances, using the same method) will affect any consumer. If you’ve ever heard of the Entourage Effect, this is essentially an algorithmic way of quantifying it.

How this works is also central to our data privacy approach: All of the aggregate data is held in our cloud inside our model, meaning that we don’t hold custody of user data; user profile information is kept on users’ devices (backed up to a third-party cloud, such as Apple’s). But this begs the question- what does the user gain from this? We know that especially now, users are incredibly skeptical to give away their data for free – so we reward them. Whenever a user answers a question, they receive in-app “points.” The number of “points” awarded per question varies based on accuracy, difficulty, and a number of other factors (gamification).

Users can redeem the “points” earned for product recommendations unique to their individual biochemistry in several ways. One method, the maximum-accuracy model, prompts the user to select a product category, then suggests a generally-ideal product based on the user’s profile, which includes their preferences. A second method, the maximum-specificity model, prompts the user to write out a description of a specific desired experience, and then suggests a product which best matches what the algorithm predicts will yield that experience (again via their profile). Both these models use generative AI to create a set of “ideal” (synthetic) products, and then match those with similar real products. The stronger the correlation between product matches, the more tokens are required to unlock the recommendation; thus, users are incentivized to answer more questions (as they then get more accurate and/or specific recommendations). Similarly, but for free, we also warn users if our algorithm detects their profile indicates a possible predisposition to addiction to certain substances, a high likelihood of negative side effects for some products, etc.; for the latter case, we also recommend alternatives that can yield better results.

Users can also access additional features on the app. They can scan products in-app, which is significantly faster than doing so with the phone camera, and then browse much more in-depth data, including their full molecular compositions, third party verification, cultivator/processor information, purchase location, misc. production and health information, the addiction prediction metric, and more. Users also have the ability to search through different Altum-scanned products of various brands, compare them side-by-side, and add them to their in-app libraries, where they can put in personal notes and share various insights and products from their library with friends.

In the future, we will work towards integrating our app with others in the wellness space through an innovative API. Being able to add new sensory inputs from technologies such as smartwatches can help users gain more accurate insights, while wellness brands that wish to use our ML algorithms can use our API to provide users with new health and wellness microapplications (similar to the WeChat model) in our ecosystem.

Market and Revenue Strategy

Due to the nature of the markets we operate in, there are several potential avenues and appetites for revenue-generating features:

1. Laboratory Testing: This is the most straightforward option, and the one in which we have an established pipeline for. They pay us, we test their products and upload all the information to our platform. Currently we have several LOIs signed and in the pipeline, as well as a national scale/expansion plan that sees us reaching $100M in revenue by the end of Y3 of operation.

2. Auxiliary Products: Due to the unrivaled access to this type of data, we can build (and have built) products that accelerate the pace at which others can do science, provide risk metrics for underwriting and more. These are ML-based products that not only have source data from our central molecular database, but continually get better/more accurate the more our customers (such as universities) use them. These products can both be licensed for revenue and co-developed with academic partners for NIH grant eligibility. We view these as low-risk, medium-reward endeavors that boost our brand image via partnerships and allow our employees to network with others outside the organization. We see this as a $100-200M-sized part of the business over 10 years.

3. Software Services: SaaS-like option where labs and producers pay a fee to use the platform. We can go about this in several ways: A monthly recurring subscription, a small fee every time a purchase is made on the platform (in this case, producers buying testing from another lab), a small fee charged every time a user scans an in-store QR code, etc. There are many different options here, but the key is to have prices absurdly low (for the time being) so that we can maximize the number of enterprise users on the platform. This has the potential to be either our lowest (free) revenue-generating part of Altum or our most profitable ($10B+).

4. API: Small fees for other biotech/digital medicine companies to use our data.

5. In-app coins (future): Users pay a monthly fee to get in-app coins faster (to redeem more recommendations). Pretty straightforward, only downside is Apple/Android’s 30% tax and we don’t get as much user data per recommendation.

6. Custom Supplements (future): Eventually (after the model is highly developed), we can start making custom-made OTC supplements that are formulated for each person’s unique biochemical needs and cognitive desires. The market for this type of product offering could be immense – well over a trillion dollars by 2030.

These are just a few possibilities of what can be done to produce revenue within our system; however, we will need the guidance of strategic partners to help us navigate which options will allow us to grow the most.

Laboratory testing is the most direct way to get to the $100M mark; each laboratory will operate completely autonomously, with the only human element being equipment maintenance and courier drop-off. This will enable us to expand naturally, something no other national-scale laboratory is currently doing: Because of the shortage of trained technicians, they are expanding through M&A, which is significantly costlier and operationally inefficient. Another huge benefit of our system is that because of our immense molecular and scientific process library, we can apply our system to any type of product, whether it be cannabis flower, mushrooms, dried herbs, powders, concentrates, or solids, on the fly. This dramatically reduces overhead costs and enables us to test an entire order of magnitude more volume than any competitor, both resulting in higher revenue and greater data mining.

The way in which we dominate the market, however, will have less to do with where our revenue comes from than who it comes from. We primarily rely on network theory to drive our marketing strategy. In our ecosystem, there are 4 important parties (user types) that we have identified as central to how we can drive our business development: Producers, Consumers, Labs, and Regulators.

We then identified what each group desires and their requirements:

- Producers:

- More Revenue (Brand Reputation, Conversion Rate)

- Lower Costs (Cheaper testing, Faster Sales)

- Consumers:

- Comfort (Easy, Accessible, Safe)

- Effectiveness (Expectations control, Outcome control)

- Labs:

- More Revenue (Speed)

- Lower Costs (Fewer processes, Less overhead)

- Regulators:

- Make their job easier (Effortless, Efficient)

Each product in our system satisfies those requirements:

- QR System (Access point)

- Increases conversion rate for producers

- Accessible to consumers

- Easy for consumers to use

- Conveys product safety to consumers

- Regulator Approval System (Verification)

- Increases Brand Reputation

- Decreases Wait Times for Products

- Makes Regulators’ Jobs Easier and More Efficient

- Molecular Identification System (Information)

- Faster Lab Speed

- Fewer Lab Processes

- Less Lab Overhead

- Faster Producer Sales

- Robotics-enabled Laboratory (Gold Mine)

- Cheaper Testing

- Faster Producer Sales

- Expectation Control (through consistency)

- User-facing App (Access Point)

- Outcome Control

- Brand Reputation

Based on these, we believe the best route is to first get as many regulators (in various states) interested in the platform as possible, then utilize warm intros and traditional sales methods to get as many laboratories then producers as possible to join (for free). After establishing a solid B2B user base, we can start to strategize marketing approaches for our branding and a hard push to increase retention of the producers’ customers as our own users. Essentially, it is a 4-step process:

1. Get regulators’ accounts set up and permissions granted

2. Get Labs to join the platform

3. Get Producers (AUCC, AUCP, AUHC) to join the platform

4. Get consumers to join the platform as our users

The key to this working is that each step makes the next easier; the previous steps have been identified as signup accelerants, so onboarding our various user types in this order will ensure sustainable growth. This process can be replicated for any type of product and scaled to any size market.

The best part about this business model is that it enables us to use our future competitors’ data (the labs) to train our own models to become significantly more accurate and will give us the data to optimize our robotics/physical lab workflow and attack where they are weak. It also gives us the most precise insight into which brands/producers may become market leaders, as we can algorithmically detect, based on user feedback and molecular information, what each brand/producer is hoping to accomplish with each batch and how well they can execute; we can both use these insights to help the brands as well as use them internally.

Each system addresses (and fixes) various bottlenecks in the free flow of information from one group to another. Once information can easily flow, the sector will grow. By bringing all the clogged “information highways” of the products under one roof, we are able to make each route significantly more efficient. We based the roles of products in our physical-digital ecosystem to be similar to that of Apple’s, with each part of our platform seamlessly integrating to give the best possible experience for our customers and users. Simply put, we are guided by the golden principle of providing the best possible value to our customers at the lowest possible cost. Additionally, when more users (of each type/group) come online, they realize the value-add of the platform in making their information distribution system frictionless; by having several group types, we essentially exponentially increase the possible network effect for growing our customers’ businesses. When they win, we win.

Apple isn’t the only company worth drawing a comparison to; Meta and Alphabet are as well. But why compare ourselves to those and not Johnson & Johnson, Thermo-Fisher, or Merck? From our perspective, those two companies are what they are today because they are the best in the world at one specific task: Obtaining useful information. Alphabet is able to scrape web information through Google (search) better than anyone else, and Meta is able to obtain personalized/behavioral information through its social media companies better than anyone else. Both of those realms, however, are on the internet. Altum aspires to be the equivalent for obtaining information about the physical world and how we interact with it, and we have invented a sustainable way to do so at scale. Imagine knowing how anything you put in your body will affect you, imagine discovering how to optimize your cognitive abilities for a specific task, imagine not worrying about if the food, drinks, supplements, or drugs you ingest might actually be slowly poisoning you. With Altum Labs’ vision, these are all possible.

If you want to talk numbers, we see Altum as a once-in-a-decade type company. If organization valuation orders of magnitude are [roughly] as follows, you can see where we aspire to fall:

$10^0 Million: A useful product (SaaS, SMB, CPG, etc.)

$10^1 Million: Profitable company that found product-market fit

$10^2 Million: Market leader but not dominating

$10^0 Billion: Dominating an emerging/small/medium-sized market

$10^1 Billion: Dominating a large market or among top few of a mature market

$10^2 Billion: Alone at the top and dictating the direction and growth of the market

$10^n Trillion: Shaping the course of humanity

We hope to be a crucial part of the foundation of a new system of how humanity interacts with the world, and the sky (or Planck length) is the limit for how many choices we improve, how many success stories we facilitate, and how many lives we help. We are in it to improve the way in which humanity moves forward, and will move mountains to impart this vision of radical good on the world.